Making your talent placement

seamless

Here at Parasol, we know the ins and outs of the recruitment industry like the back of our hand. What’s more, we understand the demands of this sector. We're continuously evolving and adapting ourselves to match your changing needs and ensure you can stay ahead of the curve. That’s why we offer a comprehensive suite of services designed to streamline operations and elevate efficiency.

Take a look at how we can help you thrive

Umbrella payroll

Our efficient system handles all aspects of your umbrella payroll administration with security, compliance and trust at the forefront. We’ll make sure all employees are paid correctly and on time, so you can focus on securing the best talent!

CIS payroll

We are specialists in CIS and understand how crucial it is for contractors in the construction industry to comply with this scheme. Our solutions provide CIS clarity and ensure accurate, timely payments to your CIS contractors and subcontractors.

Recruiter funding

We know that maintaining a positive cash flow is essential for paying your staff and suppliers on time, while still having enough available to invest in growth opportunities. Parasol’s recruitment financing services offer the financial stability you might need to keep all your business goals powering forward.

EOR and global payroll

Country-specific legislation can be tricky to navigate. Parasol’s global payroll solution provides you with invaluable insight and guidance on how to stay compliant. Our innovative solutions minimise your administrative burdens, allowing you to place contractors wherever opportunity may call across the globe. We make competing on a global scale easy.

Refer a contractor

Want to speed up yours and your candidates onboarding process? We've got you covered.

Refer a colleague

Know a colleague who could do with our help sorting their candidates employment? Call your account manager or our team on

Benefits for Agencies and Hirers

We believe in exceptional service and unparalleled support across all our partnerships. Our commitment to you is to deliver strategic guidance, optimise payroll processes, and drive business success. We work hard to tailor all our services to your individual needs, so you feel empowered to take on your workforce and navigate everyday challenges.

Here are just some of the benefits you can expect from our services:

- Flexible workforce opportunities, with companies in the UK and abroad now able to benefit from worldwide workforces

- Enhanced compliance with tax laws and regulations all around the world

- Technology-focused, innovative solutions that simplify payroll processes and reduce both administrative burden and processing time

- Minimised risk of non-compliance errors and penalties, saving you money and time

- Versatile, scalable solutions that can be adapted to your/your agency’s needs

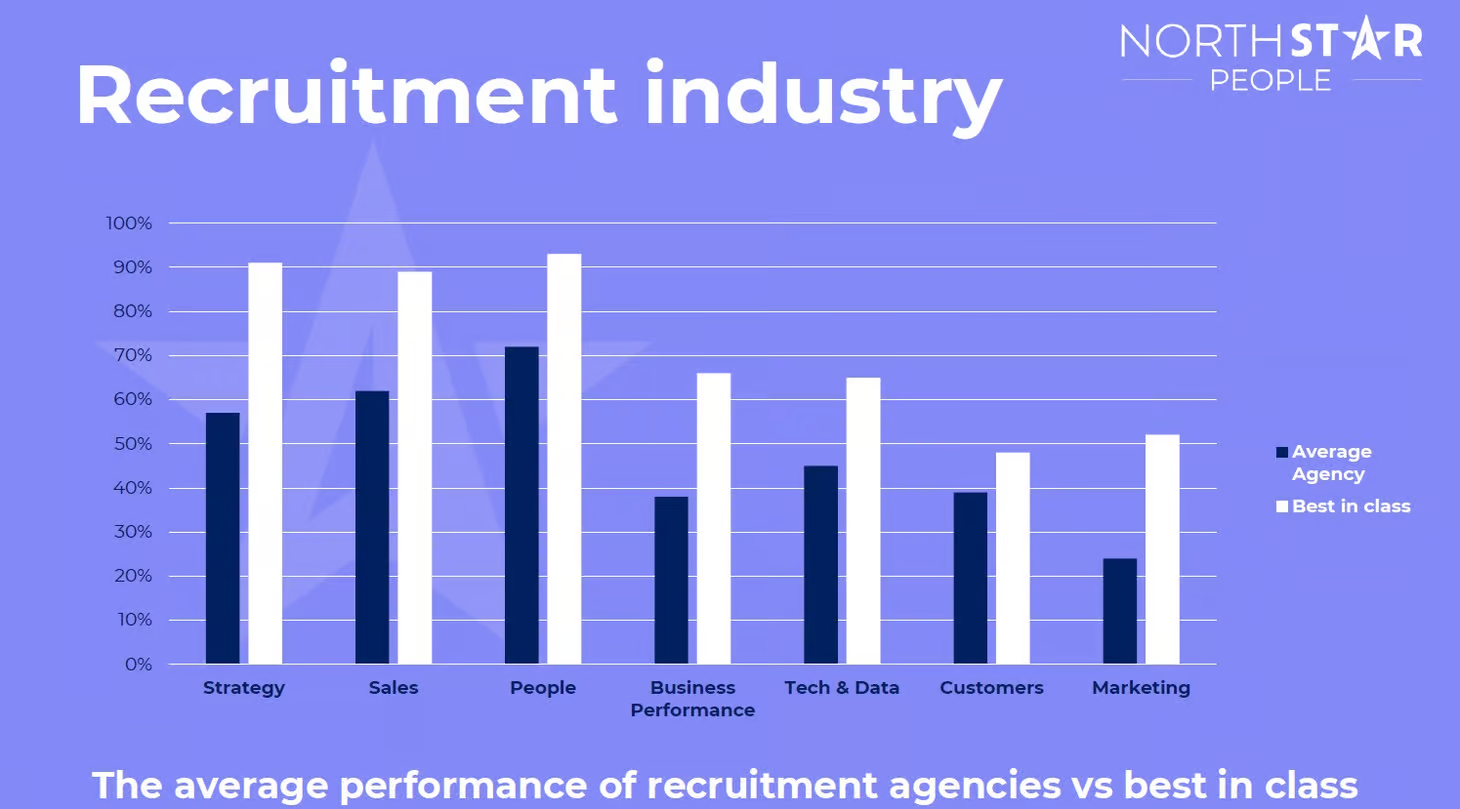

Benchmark your agency against the industry

Want to understand where your agency is against your competitors and the industry average?

If you've got 30 minutes, this health check will tell you exactly that. And, it will also give you prioritised, actionable insight to improve.

Interested?

Calculate your contractors take-home pay

Calculate your contractors take-home pay

Calculations are for illustration purposes only and are based on a series of assumptions.

Meet our team

We are a team of professional, friendly experts with extensive industry know-how and expertise. Whether you need to speak to our Agency Sales team or the operational experts in our Partner Support Team, we’re on hand to ensure you and your agency receive the premier level of service you can expect from Parasol.

Speak to our team

Gold standard protection with Parasol. As a founding member of the FCSA, we put compliance at the heart of everything we do. Be safe in the knowledge your tax will be paid correctly and on time, keeping you on the right side of HMRC.

With Cyber Essentials PLUS, your data is protected by the best-in-class security safeguards. Developed and operated by the National Cyber Security Centre (NCSC), it is one of the best steps we can take to secure your data.

Want to know you’ll be given a top-tiered service? Don’t just take our word for it, take a look at our Trustpilot score. We have a 4.7* rating out of 5, with over 4,300 reviews (and counting!). You can trust that we'll give you great service.