How you'll benefit

Here's why thousands of recruitment agencies and construction workers trust Parasol.

Trusted by 3,000

agencies & end clients

Over our 25 years in the industry, we’ve worked with over 3,000 UK recruitment agencies and payrolled over 250,000 employees, so you’re in good hands.

FCSA

accredited

As a founding member of the FCSA, you can rest assured that you’re fully compliant with HMRC and the latest employment regulations.

On-hand

support

We have a large, experienced team of Client Relationship Managers, so you’ll have a dedicated point of contact on-hand to help in-person, over the phone, or by email.

- Due diligence taken care of, including ID, SDC checks and verification of CIS status with HMRC.

- Tax return & rebate assistance if required via our sister company, baa accounting.

- Friendly CIS support team to provide assistance and answer queries.

- Swift weekly payments and automatic SMS alerts once payment is confirmed.

- Comprehensive insurance covering workers under Professional Indemnity, Public Liability and Personal Accident cover.

- Straightforward onboarding with minimal disruption.

- Online portal available 24/7 to view important details and pay statements in one place.

What's in it for your construction workers?

Save £1000s with Parasol Rewards

MyMarketplace exclusive discounts

Dedicated support team

Simplified admin

Comprehensive insurance

24/7 online portal, MyParasol

CIS

rebate support

Paid on time, everytime

Personal accident cover

Get in touch to learn more.

Claim online or by post

Claiming a rebate through Baa is quick, easy and hassle-free.

No upfront costs

No hidden fees. The fee is simply taken out of the rebate.

25 years' experience

Baa (formerly Brian Alfred) has been a leader in CIS since day one, so your workers are in good hands.

Claim up to 4 years

That's a lot of cash back for the next holiday!

Have confidence in compliance

Regular, high-level

audits & testing

Our accreditation with the FCSA and APSCo mean we undergo stringent annual audits and robust financial stability tests to evidence delivery of compliance at the highest levels.

Keeping you

ahead of the game

FCSA and APSCo members meetings are regularly attended by Parasol and Caroola representatives. These allow us to receive updates and be instrumental in sharing our expertise on upcoming legislative change.

Reliable,

online security

With Cyber Essentials PLUS, your data is protected by the best-in-class security safeguards. Developed and operated by the National Cyber Security Centre (NCSC), it is one of the best steps we can take to secure your data.

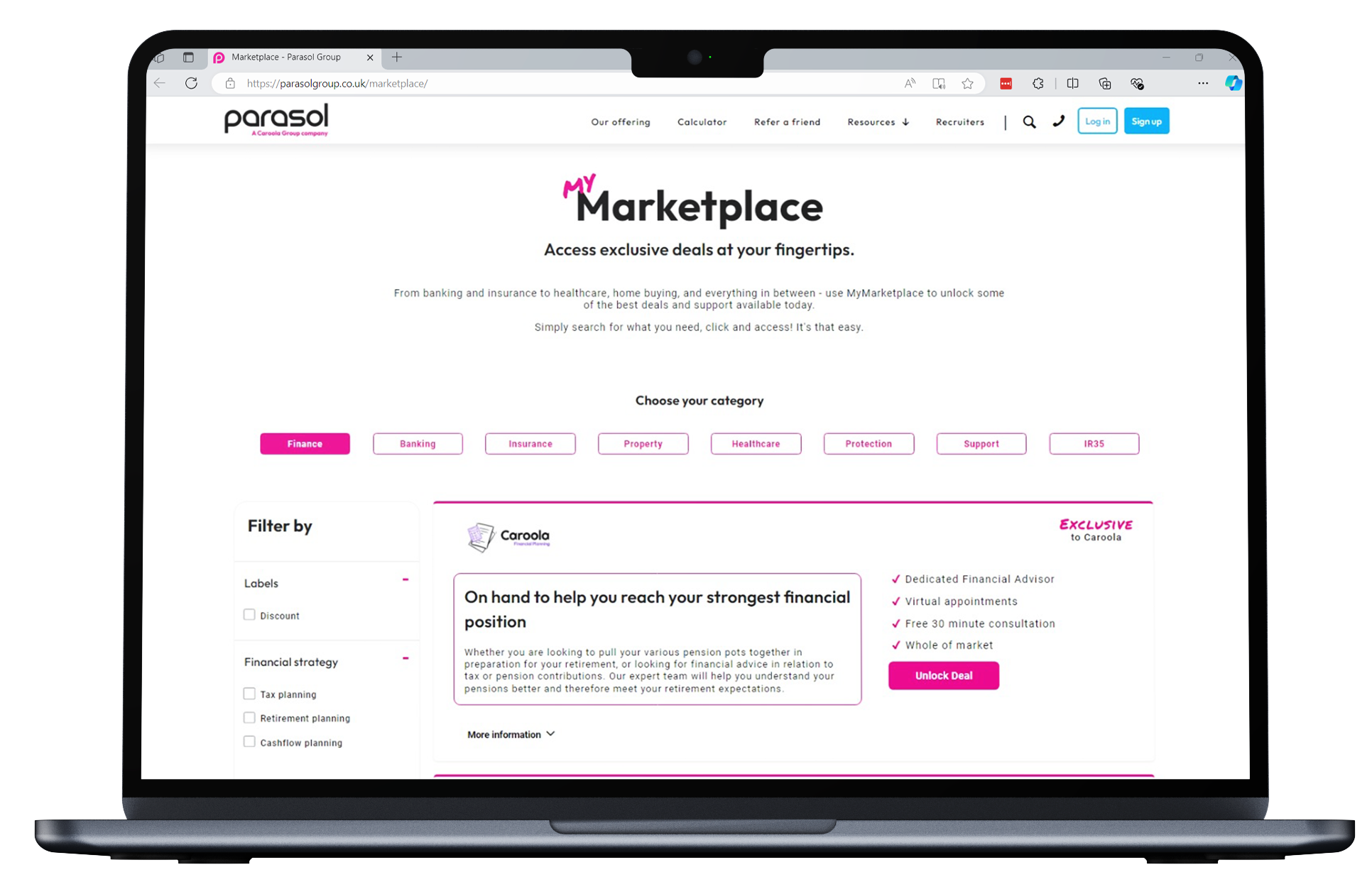

MYMarketplace

Exclusive deals at your fingertips.

Both you and your workers gain access to a variety of deals and discounts across healthcare, home buying, insurance, pensions and more. So what are you waiting for?